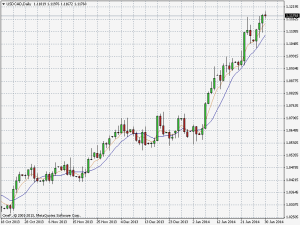

USDCAD continues its ascent as the Fed doesn’t disappoint.

January 30, 2014After yesterday’s FOMC 1900 GMT, the dollar has continued to push higher giving us a continued reason to be long USDCAD.

One of the trades we have been focusing on since the start of the year has been to buy USDCAD. This is a pair that has started trending very well since the start of the year, and we feel this will still be strong for a while yet, due to the different cycle points of the relevant central banks.

The Fed as expected carried on with their tapering yesterday, and it looks like they have a scaled plan on how they want to exit the stimulus programme. The BoC on the other hand have recently been talking about cutting interest rates to weaken the CAD and help their exporters out.

Over the last few weeks we have had a buy on dips policy, adding more into our positions as they have hit our moving averages, and we stay in the trade for now as nothing has changed central bank wise yesterday. We feel this could keep going for a while yet, but are trailing stops up all the time.

In terms of upside resistance we view the 50% Fib of the move down from 1.3060 March 2009 high, to the 0.9410 July 2011 low, at 1.1223 where we will take some profits, and then the 61.8% Fib of the same move at around 1.1650.