Eurozone CPI out at 10 am GMT with the market still focused on yesterdays German inflation data

April 30, 2014So yesterdays soft German inflation data saw EURUSD drop 50 pips in a matter of minutes with the intra-day high coming in at 1.3878 and we now have session lows today of 1.3796, we have Eurozone CPI out today which is likely to give EURUSD another leg lower should the number disappoint on the downside as this would give the ECB further reason to adopt a looser monetary policy and start to put some action behind there recent dovish rhetoric.

Should today’s data come in lower then expected there will be a lot of pressure on the ECB to follow up with what they have said and act, a rate cut is one potential or potentially a form of QE, the outcome of either should be for the EUR to weaken across the board and create some of the import led inflation and boost export profits, whether this works or not as a monetary tool remains to be seen as we only need to look across the pond at the states and there inflation data to suggest it doesn’t, unless you were to look at inflation within the stock market which has rallied considerably on the back of QE from the FED.

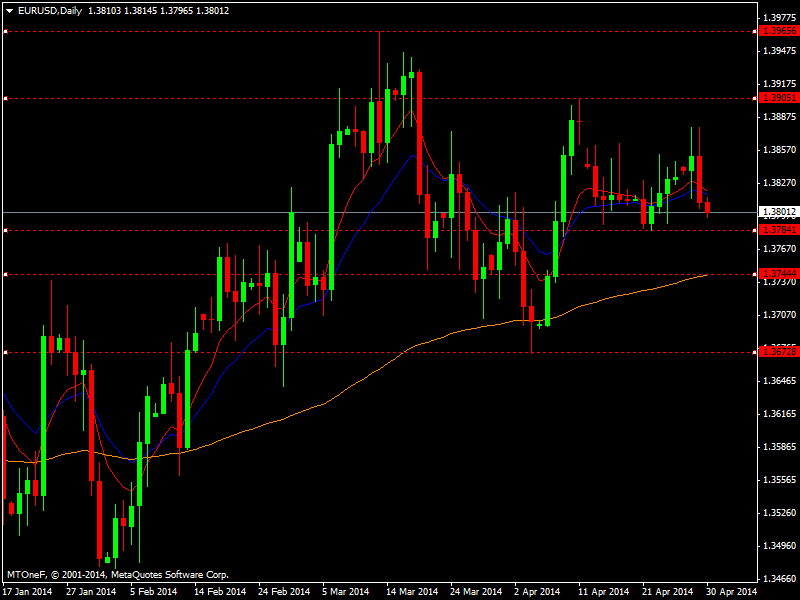

If we look at the bigger picture for EURUSD on the daily chart below we can see clear support now at 1.3785 should we break on the downside, below there is the 100 day exponential moving average coming in at 1.3744 but the main level will be the 1.3673, the closeness of these levels only goes to show the narrow ranges EURUSD has been trading in of late and the lack of volatility in the markets. This can often lead to larges move when we break out though.

Should we break lower it is worth thinking ahead to this evenings FOMC and then this Fridays NFP, we will then await next Thursdays ECB rate decision to see the effects of this data, I do not expect this to be plain sailing lower in the EURUSD, I like being short for a longer term move but will be buying EURUSD when it gets overextended on the downside and near to some key technical support levels.