Gold Forecast for this week…

February 17, 201417/2/2014 (12.45pm). Last week Gold prices ended at a high of $1319 after touching $1321.30 breaking above the $1315 obstacle rising gradually following Janet Yellen’s testimony and lackluster economic data in the US supported by the weakening of the dollar. There seems to be belief that monetary policy will become more accommodative under Yellen and that the pace of tapering may be slowed down boosting gold’s appeal as a currency hedge.

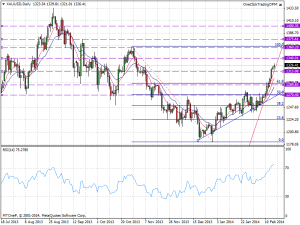

So to recap on Friday Gold prices broke above the $1300 level without too many hurdles closing near the $1320 level. Hence we now feel that this market has broken out considerably and at this point we believe that pullbacks should provide good buying opportunities. If the bulls continue buying we expect prices to challenge the first resistance level at $1340, where an upward trend may give way for the next resistance level at $1360. If we can get beyond this $1360 level then this market could really start to take off at that point targeting the $1400 level. The RSI is currently within its overbought region therefore some consolidation or a pullback at some point in the development of further advances cannot be ruled out as prices are also testing the 200-day moving average. Nonetheless we have no interest in selling as we see ample support below particularly close to the $1280 level which was the original breakout.